F.I.R.E. – Financial Dependence, Retire Early, has been a very hot topic in recent years.

Simply speaking, FIRE followers aims to 1) save a big pile of money as early as possible, 2) once you reach your goal of saving, you retire from your job and withdraw from your high dividends stock/mutual fund and other investments to pay for your expenses. In essence, you are supposed to withdraw at that rate FOREVER without running out of your principal.

Before you dive into FIRE, ask yourself WHY. Why you want to retire early? What are you going to do with your retirement life?

- If you want to quit your job simply because you hate it, is early retirement the only option? Or, is it the best option? Can you change your nature of work? “Don’t throw the baby out with the bathwater” so that you don’t reject the favorable (the sense of achievement or the relationship build at work) along with the unfavorable (your job).

- Do you have a hobby or something you’re passionate about to occupy your time after retirement? The key is not retiring from your work, but to retire into something better. Do you have something better lined up in your retirement? If all you do in your spare time is browsing the web or watching TV dramas, do you think you will be happy doing that for the rest of your life? .

- What is your way to enjoy your life? If you ideal retirement is travelling around the world, living in an expensive city, spicing up your wardrobe every season and sending your kids to private schools from preschool to college, even $200K passive income a year will not be enough. If you simply love to enjoy the nature, i.e. hiking, fishing or camping, and you’re also willing to move to a city where the living expenses are relatively lower, you probably get away with less in your savings.

- If your goal is to raise a family full time, you probably should start saving up REALLY early so that you will not miss your biological clock to have a baby. People generally agree that it is best to be able to raise your kids full time. And you may get carried away and feel super nice thinking that you’re always there for your kids. However, is it always that rosy?

Let’s take my friend’s family as an example. My friend’s father sold his business in his mid 30s. From that time onward, his daily routine begins with swimming for an hour in the morning, then he goes home to have breakfast, reads the newspaper, has lunch, takes a nap in the afternoon, cooks dinner and then goes to bed.

Is my friend inspired by her father and want to follow the footprint? Absolutely not. In her own words, “my father is not working nor contributing to the society. I don’t know what kind of example he wants to set for us by doing nothing in his life”. She never mentions how nice it is to have her parents with her all the time. In hindsight, my friend’s father loses the respect from his kids by not working. Again, working doesn’t necessarily equivalent to having a full time job. But if you don’t retire into something, continue learning and contribute to the society, it may not be well received by your kids.

If you decide that FIRE is for you, let’s see how you can be a FIRE.

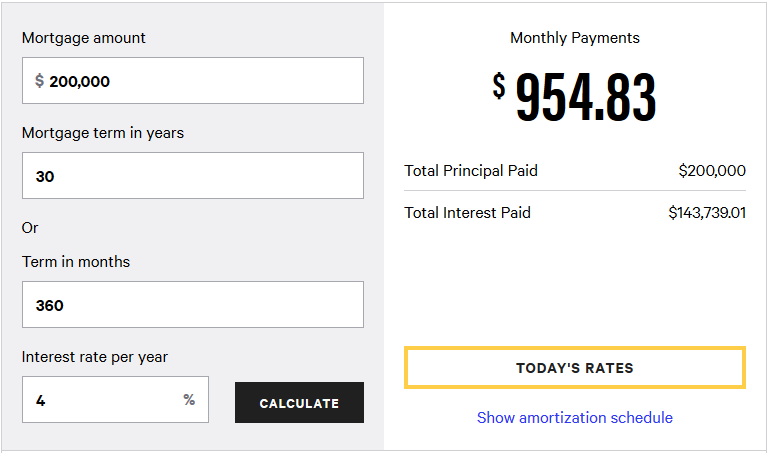

For example, if there are a team of husband and wife with annual income of $200K and their overall federal + state income tax is at 30%. After tax, they have $120K left. Let’s assume that they can save 70% of their incomes, so they will save $7,000 monthly. Using the compound interest calculator, with $0 initial investment, $7,000 monthly contribution, an 8% annual return and compounded monthly they will reach $2M in 14 years.

Let’s examine a couple of assumptions and qualifications for you to be successful in FIRE .

#1 Your annual income has to be at a certain level.

Many bloggers share their experience to be FIRE; most of them work in pretty high paying industries. For example, The Money Habit and Financial Samurai was in investment banking, and Mr. Money Mustache was in engineering and computer science. Without that, it is very difficult to have that big pile of cash to start off the FIRE journey.

#2 You need to start early and be extremely frugal.

Usually, the FIRE endeavors want to retire fairly early, say 40 or earlier. Taken the ideal example early, the couple will be using $3K per month, and it takes 14 years to be there. People who successfully achieve FIRE by mid 30s employ extreme measures to save at least 70% of their incomes, such as:

- Share an apartment with others so you can split the rent and utilities regardless if you’re single or married (with or without kids). Or, rent out the spare bedrooms in your own home.

- Almost no dining out, and only eat at home.

- No new clothes (except underwear or socks).

- Travel at a very minimal level in terms of budget.

- Minimize money spent on transportation, preferably working from home all the time.

- Clip coupons and drive out of your way to different stores to score the best deal in various categories of items. Plan your route carefully so you can save gas for your errands.

The list can go on and on. And you should lead this extreme lifestyle in your 20s and 30s in order to achieve FIRE. But that’s your early adulthood, your golden years before having kids or taking care of aging parents. These years are the best for traveling and experiencing the world. Trying different things out so you know what you are passionate about. Or, you should hang out with friends, may that be a movie, brunch, or visit a city together. These are seeds for lifelong friendships. All these experiences enrich your soul and mold you to be a more mature person. Can you put a price tag on them and run the analysis if the cost is worth it?

#3 The sustainable withdrawal rate is based on the historical data/past performance.

The performance data shown represents past performance, which is not a guarantee of future results. Investment returns and principal value will fluctuate, so that investors’ shares, when sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data cited.

We don’t know the future. So you may want to park more money that suggested so that you don’t risk running out of your savings.

In addition, if you retire early, your time horizon relying on your saving is not 20-30 years like most people who retires at 65. If you retire at 40, you will be on your saving for at least 30 years, and my even be 50 years or more.

#4 You may be a lot more worried in the stock market crash or economic downturns.

Provided that your portfolio for retirement is based on the stock/bond market, your principal will be highly coupled with the market. Do you remember the tech bubble in the early 2000, or the 2008 stock market crash? If you’re too young to remember that. Just imagine if you experience a 35% drop in your retirement principal in the matter of 2 months, do you have an iron stomach to absorb that news and sleep peacefully at night especially that’s all you rely on as income?

The Final Verdict

It sounds like I’m against FIRE. Actually, I’m not. It is good to have a fresh look at work and money and how to balance our lives with them. But it is important to carefully examine an idea before we get carried away by the potential benefits coming with it. Everything has its pros and cons, and FIRE is no exception.

FIRE is great for someone:

- Who is at a certain level of income so that it is possible to stash away a big portion of his income to build the savings needed to retire early.

- Who is good at being frugal and don’t find that restrictive.

- Who plans to control expenses very well after retirement.

- Whose way of enjoying life does not come with a hefty price tag.

- Who has something he wants to devote his attention full time after quitting his job. Ideally, this passion can also be a side hustle to bring in some income.

- Who does not have responsibilities for others financially. If you have aging parents who do not have enough for their retirement to lead a reasonable life, do you want to help? For me, it’s impossible to watch my parents living miserably and tell them, “Sorry, I can’t help you because I’m on my path to FIRE”. How about your kids? If they are into swimming and join the swim team which requires a lot of travel to swim meets, do you have a budget to support them?

However, I strongly believe in the principles of watching your expenses, saving diligently, setting budgets, investing regularly and creating passive income sources. These are all great ideas from FIRE. And it is definitely nice to have the option of working or not. However, giving lots of experiences and opportunities during your 20s and 30s to save enough to retire at 40, I am not sure if that is for everyone. You are putting all your eggs into one basket assuming that you will be happily ever after once you are FIRE. Is life really that simple?